Exclusively For Canberra Homeowners With 2+ Years On Their Mortgage — Ready To Turn Equity Into Passive Income Without Touching Savings Or Sacrificing Lifestyle

How Canberra Homeowners Are Unlocking $100K+ In Property Equity Through Expert-Led Refinancing — And Using It To Secure Passive Income Without Extra Savings Or Leaving Their 9–5

A Low-Risk, Fully-Managed Finance Strategy That Protects Your Lifestyle While Unlocking $100K+ In Equity To Begin Building Long-Term Wealth

EquityToIncome™ Is A Surer Path To Passive Income — Tailored For Homeowners Who Want Growth & Security. We Show You Exactly How To Access Equity You Already Have, Secure A Better Loan Structure, And Begin Investing In Income-Generating Property Without Stress, Surprises, Or Steep Learning Curves.

See How Everyday Homeowners Are Quietly Building Property Portfolios — Book Your Strategy Session Now And Learn The Simple, Low-Pressure Way To Start Growing Income Outside Of Your 9–5

We Turn Untapped Home Equity Into Strategic Property Investments For You…

Implement The Exact Equity Unlock & Reinvestment Strategy Canberra Homeowners Are Using To Build A Second Income Stream — Without Savings, Stress, Or Sacrificing Their Lifestyle

If you’ve been paying down your mortgage for 2+ years, your property could already hold $100K+ in usable value. EquityToIncome™ shows you exactly how to access it safely, secure a smarter loan, and start building passive income through a fully-managed investment roadmap — designed to grow your wealth while protecting your financial stability.

Uncover The $100K+ In Usable Equity Most Homeowners Don’t Even Know They Have

Your Personalised Equity Assessment & Home Loan Review

Most homeowners are unaware they’re sitting on $100K+ in usable equity — and doing nothing with it.

That equity could already be working for you to create a second income stream that supports your lifestyle, future goals, and accessing more freedom and security.

This is where we start: a full property and lending analysis that shows you exactly how much you can access, based on real lender criteria — not rough estimates.

From there, we build a simple, step-by-step strategy to help you use that equity to generate income, safely and without needing savings, complex decisions, or big lifestyle changes.

Borrowing Power Modelling & Investment Strategy Session

Next, we model your borrowing capacity and show you the real-world income scenarios based on your financial profile.

You’ll see what type of investment property you can secure, how much rental income it could produce, and how it fits into your long-term financial goals.

We eliminate the guesswork and give you a data-backed plan built for stability and growth — even if you’ve never invested before.

Lender Comparison & Custom Loan Structuring

With access to over 30 lenders, we identify the smartest loan strategy to maximise your equity use, minimise interest, and structure for future investments.

Whether it’s refinancing your current loan or optimising your lending for investment purposes, we ensure you get a deal that supports your income goals — not just another cookie-cutter mortgage from the big banks.

Full Refinance Management, End-To-End

We take the pressure off by handling the entire refinance process — from application through to settlement.

No paperwork headaches. No back-and-forth with banks. No delays.

Just expert-driven execution that saves you time and delivers a better loan structure that frees up capital and creates a path to growth.

You stay in control, without lifting a finger.

Strategic Guidance To Acquire Your Investment Property

Once your lending is in place, we guide you through the next phase: acquiring your first (or next) income-generating property.

From timing the market to making sure your loan supports your investment, we give you a step-by-step roadmap to move forward confidently.

You’re not just refinancing — you’re setting up a long-term wealth-building system tailored to your lifestyle, risk profile, and financial future.

From The Desk Of The

Joseph Beltrame

Senior Broker, Ember Finance Group

Equity Investment Finance Specialist

The biggest financial mistake I see Canberra homeowners make — and the reason many stay stuck on a single income, overpaying interest year after year?

They don’t use the equity they’ve already built.

You’ve probably heard people talk about “using your property to build wealth” — but no one ever shows you how to do it safely, without draining your savings or taking on risk.

So what happens?

Most homeowners sit on six figures of untapped value, thinking they’ll “look into it later”... while others are out there buying smart investment properties, creating rental income, and moving closer to financial freedom every year.

The truth? It’s not your fault.

Banks won’t explain how to restructure your loan for investment. And the idea of refinancing and investing feels overwhelming — especially if you’ve never done it before, and don’t want to risk your home or your financial stability.

That’s exactly why I created EquityToIncome™.

We simplify the entire process — starting with a property and lending analysis that uncovers how much equity you can access, followed by a step-by-step strategy to model your borrowing power, choose the optimal investment loan structure, and manage your refinance from application to settlement.

You’ll walk away with a smart strategy, a better loan, and the first step taken towards creating a second income stream through property — all with zero upfront capital, no investment experience, and no disruption to your current lifestyle.

We know the Canberra market. We know how to structure loans for investment. And we know how to turn passive homeowners into confident investors — with a proven, low-risk process that just works.

If you’ve been sitting on your equity with no clear plan to use it, now’s the time to act. Because standing still financially isn’t safe — and the longer you wait, the further behind you fall.

This is your next move — and we’re here to guide you through it.

"We Take This Strategic Wealth-Building Process And Build It Around Your Financial Position, For You"

You don’t need to figure out equity, refinancing, investment strategy or lender negotiations on your own. Property finance and investment structuring is what we do — day in, day out.

Having worked with countless Canberra homeowners, we know exactly how to identify untapped equity, model passive income potential, and implement loan structures that unlock real results — safely, and without disrupting your lifestyle. We’ve built the systems, processes, and lender relationships to deliver clear outcomes, not confusion.

You could spend months researching refinancing options, trying to understand complex borrowing calculations, comparing lenders, and attempting to piece together an investment plan through blogs and forums… all while second-guessing every move.

Or — you could shortcut the entire process by partnering with professionals who specialise in turning your home equity into income, know the Canberra market inside out, and can manage everything for you from start to finish.

EquityToIncome™ is the smarter, safer way to move forward — with a clear strategy, expert execution, and no overwhelm.

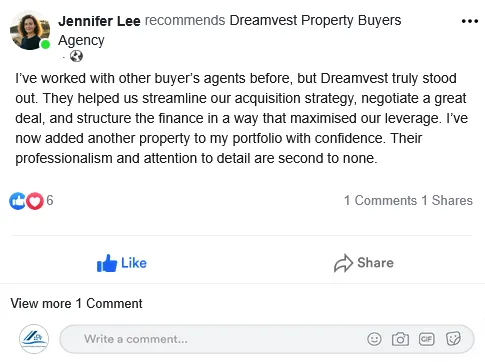

But Don't Just Take Our Word For It....

Execution Case Studies

Helped A Canberra Couple Unlock $137,000 In Equity And Secure Their First Investment Property Within 90 Days

This Canberra-based couple had been paying down their mortgage for over 7 years with no clear investment strategy. They didn’t realise they had over $130K in usable equity sitting idle in their home — and were still overpaying on a high-interest loan.

Through the EquityToIncome™ process, we completed a full loan review, modelled their borrowing power, and restructured their loan with a better lender, freeing up equity without impacting their day-to-day lifestyle. Within 90 days, they had not only refinanced into a stronger position but also secured their first investment property generating over $500 per week in rental income.

This was their first step toward financial freedom — and it was done without dipping into savings, adding stress, or taking risks. They’re now on track to add a second investment in the next 12–18 months as part of a long-term strategy we mapped together.

This is the power of having the right system — built for everyday homeowners, not finance experts.

We Personally Use The Same Strategy We Recommend To Our Clients — It’s How We’ve Built Long-Term Wealth Ourselves

We don’t just talk about using equity to create financial freedom — we’ve done it ourselves. This is the exact strategy we’ve followed personally to refinance smarter, unlock equity, and reinvest it into well-structured property assets that build income over time.

We’ve worked with the same lenders, faced the same roadblocks, and used the same modelling and structuring methods we now deliver to clients. That’s what makes EquityToIncome™ different — it’s not theory, it’s lived experience, backed by data and delivered with expert execution.

When you book your Strategy Session, you’ll get full transparency. We’ll walk you through the exact process we use — from the numbers behind the refinance, to the investment roadmap we’ve followed ourselves to build long-term stability and scalable income.

We practise what we preach — and we know this works because we’ve walked the path ourselves.

"Unlock $100K+ In Usable Home Equity And Start Building Passive Income With A Proven, Done‑For‑You Strategy"

The key to building long‑term financial security is using the equity you already have — safely and strategically.

With EquityToIncome™, you get a battle‑tested, fully managed process that reviews your current loan, models your borrowing capacity, structures the smartest investment‑ready refinance, and guides you toward securing your first income‑producing property.

No guesswork, no overwhelm — just a clear, expert‑led pathway to create a second income stream without touching your savings or changing your lifestyle.

Learn How To Unlock $100K+ In Usable Home Equity And Turn It Into A Second Income Stream Through Smart Property Investment

Stop letting untapped equity sit idle while others are building wealth.

EquityToIncome™ gives Canberra homeowners a proven, done-for-you strategy to refinance smarter, access up to $100K+ in usable value, and start generating rental income — without needing savings, taking on risk, or changing your lifestyle.

We handle the process end-to-end so you can confidently move from passive homeowner to income-producing investor.

The EquityToIncome™ Wealth-Building Process

Your Equity Review and Value Assessment

We begin by reviewing your current mortgage and assessing how much usable equity is available in your property — often $100K or more.

This is the foundation for everything we build. Most homeowners don’t realise the value they’re sitting on, and we show you exactly how to unlock it safely, without disrupting your financial stability.

Borrowing Power Modelling & Income Strategy

Next, we model your borrowing capacity across multiple lender scenarios and present you with tailored income projections.

You’ll know what kind of investment property you can afford, what rental income it could generate, and how it fits into your long-term goals — with full transparency and expert guidance at every step.

Lender Comparison & Smart Loan Structuring

We compare over 30 lenders to find the best refinance deal that supports your investment goals. Then we structure the loan for performance — reducing repayments, increasing borrowing power, and setting you up to grow your property portfolio over time.

No cookie-cutter banking. Just strategic finance done right.

Full Refinance & Loan Process Management

We handle the entire refinance process from start to finish — including paperwork, application, and settlement. You don’t need to chase banks or worry about delays.

We do the heavy lifting while you stay focused on your life. It’s streamlined, stress-free, and built for busy homeowners who want results without hassle.

Investment Property Guidance & Next Steps

Once your refinance is complete, we provide expert guidance on your next move — acquiring an investment property that generates passive income.

You’ll have the borrowing power, loan structure, and strategy in place to move forward confidently, knowing you’ve taken the first step toward financial freedom and long-term stability.

Client Results:

Check Out Some Feedback Provided By Our Clients...

Frequently Asked Questions:

Do I really need savings to get started with EquityToIncome™?

No — that’s the beauty of the strategy. Most clients use the equity already built in their home as the deposit for their investment property. You can start without dipping into your savings or changing your lifestyle.

How do I know if I have enough equity to invest?

We start by running a personalised property and lending analysis that shows exactly how much usable equity you have — often $100K+ or more. Most homeowners are completely unaware of their current borrowing power until they see the numbers laid out clearly. This is what unlocks your next move and allows us to build a strategic pathway forward.

A strategic pathway forward to building that diversified, passive income stream

Will refinancing increase my monthly repayments?

Not necessarily. In many cases, clients secure a better rate, reduce interest costs, or restructure their loan for improved cash flow. We compare 30+ lenders to ensure the refinance supports your goals and remains comfortable for your budget.

Is investing in property risky if I’ve never done it before?

Our process is built specifically for first‑time investors. We model scenarios, project rental income, and structure your lending to minimise risk. You’re guided step-by-step, with every decision backed by expert advice and real data.

What if interest rates rise — does this still make sense?

Yes. That’s why loan structure is so important. A smart refinance can protect your cash flow, secure competitive rates, and give you stability even in a rising-rate environment. We build your strategy with future-proofing in mind.

How long does the whole process take?

Most clients complete their refinance and are ready to move forward with their investment strategy in 30–60 days. The timeline depends on lender processing and your personal circumstances, but we manage everything end-to-end.

What makes EquityToIncome™ different from speaking directly to a bank?

Banks only offer their own products and rarely structure loans with investment growth in mind. We compare 30+ lenders, tailor the structure to your long-term goals, and guide you through building passive income — something banks simply don’t do.

I’m busy — how much time will this require from me?

Very little. We handle the research, lender comparison, paperwork, modelling, and refinance management. You simply attend your Strategy Session, review options, and make informed decisions. We’ve designed the process for time-restricted homeowners.

What if I’m not sure I want an investment property yet?

That’s perfectly fine. The purpose of the Strategy Session is clarity — understanding your equity, borrowing power, and options. You’ll walk away knowing exactly what’s possible, even if you choose not to move ahead right away.

Is this suitable if I already have an investment property?

Yes. Many clients come to us with one property but haven’t structured their lending for portfolio growth. We can optimise your loan strategy, unlock additional equity, and help you take the next step with confidence.

© Copyright 2025 Ember Finance. All rights reserved.

Reproduction or duplication of this website or contents is strictly prohibited.

View Privacy Policy & Terms

Disclaimer: Results apply to each person based on their circumstances and current market situation

.